When we talk about our “Online Enrollment,” there is so much more to it than meets the eye. So rather than give you a generic description, we thought we’d share an FAQ that will give you an in-depth view of what’s behind our online enrollment solution.

This 2-part Online Enrollment FAQ series covers everything from the nuts and bolts of the technology to the practical usability aspects in everyday enrollment situations. For Part 1, we’ll start by giving you a crash course in what it is and how it can be configured uniquely for the needs of the Employer and Payer.

How would you describe the HPS Online Enrollment in 20 words or less?

It’s a rules-based solution that creates targeted online enrollment experiences and workflows for Members, Employers, Brokers, and Healthcare Payers.

Is the online enrollment a third-party solution that you’ve just integrated into your portal product?

No. The online enrollment was developed by us and is supported by us from our corporate office in San Antonio, TX.

For what purpose is the online enrollment most commonly used?

It’s most often used for ongoing adds, deletes, and changes; however, several clients also use it for new hire enrollments and annual open enrollment.

What types of companies use HPS’ online enrollment?

Our online enrollment solution is used by a wide range of Healthcare Payers, including fully insured carriers, third party administrators, healthcare trusts, and also by Medicare and Medicaid administrators. It is deployed and utilized both domestically and internationally.

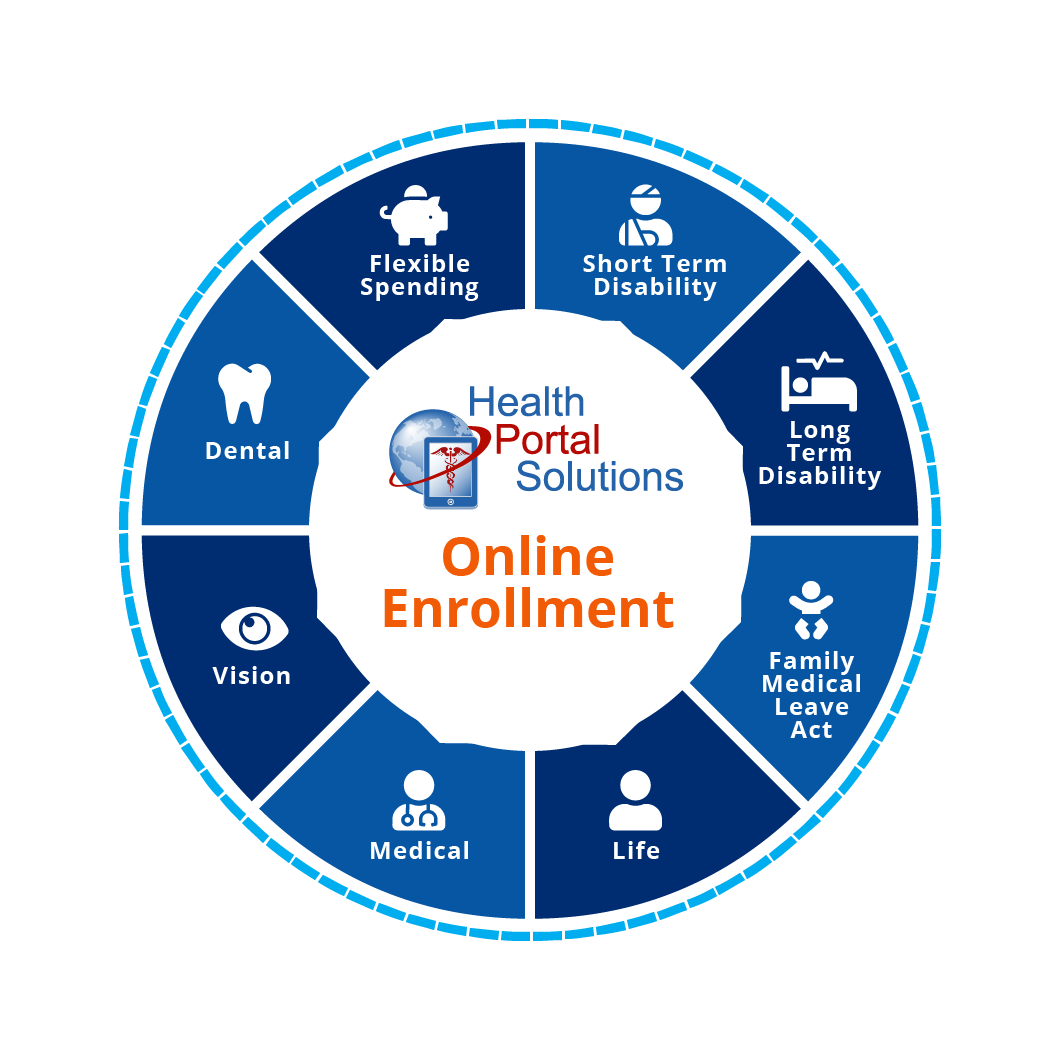

What types of benefits and coverages are supported by the HPS online enrollment?

The enrollment will support virtually anything. We’ve facilitated enrollment in medical, dental, vision, FSA, HSA, life, and disability. We’ve even had clients do gym membership enrollment through our solution. Our database design and architecture has been built to optimize the flexibility and scalability for the various enrollment benefits and options.

When you talk about flexibility, what exactly do you mean?

Our enrollment solution is rules-based, which means the license-holder can control and define what coverage and benefits options display for whom. At the highest level, this means our clients can control what benefits, coverages, and options display for specific Employer groups. At a deeper level, our client can define what options can display for members of a specific Employer group based on the member’s age, tenure, full time/part time status, and other factors. These types of configurations are configured differently for each Employer, which provides a diverse set of online experiences targeted to the individual member.

Can you give an example of one of the more complex enrollment setups you’ve seen?

Some clients have Employers who are broken down into divisions. These divisions often represent different groups of benefits-eligible employees, such as retirees, COBRA participants, union employees, or others. For these situations, enrollment is not configured at the Employer level but rather at the lower Division level. At this level, often times certain plans are exclusive to a division and other times benefit plans overlap across divisions. Whatever the case may be, the HPS online enrollment lets Payers customize the benefits and workflows to the specific requirements of each division. This ensures members see the options appropriate for them and helps the Payer more easily manage unique workflows across their Employer base.

Health Portal Solutions’ Online Enrollment is a robust, flexible, and scalable solution designed to accommodate the unique business needs for Employers and Payers. Next time in Part 2 of this FAQ, we’ll go into more detail about how this flexibility translates into the online experience and how it can streamline workflows for enrollment processing.

Until then, if you’d like to learn more through an online demo, please contact us.